The chair of the U.S. Securities and Exchange Commission (SEC), Paul Atkins, offered a major shift in the agency’s stance toward crypto fundraising on Tuesday, saying that most initial coin offerings (ICOs) should not be regulated as securities — overturning long‑standing assumptions about token offerings Responding to reporters at Blockchain Association’s annual policy summit, he said, “That’s what we want to encourage. Those sorts of things would not fall, as we would define it, into the definition of a security.” Paul Atkins, a longtime advocate of lighter-touch financial regulation, has become one of the most market-friendly SEC chairs in recent years. His stance carries weight because previous SEC leadership took the opposite view, arguing that virtually all ICOs were securities. Atkins’ comments, therefore, signal a notable ideological shift at the top of the agency, one that could influence rulemaking debates across Washington and ongoing enforcement strategies. Atkins signals major shift in SEC’s crypto approach Atkins was pointing to a token taxonomy he established last month, in which he categorized the crypto industry into four general token types. Among the four categories, Atkins argued last month that three—network tokens, digital collectibles, and digital tools—should not be considered securities in and of themselves. On Tuesday, Atkins stated that ICOs involving those three token categories should likewise be treated as non‑security transactions and, as such, would fall outside SEC regulation. The only category of token the SEC chair said his agency should regulate, when it comes to ICOs, are tokenized securities—representations of securities already regulated by the SEC that trade on-chain. “ICOs transcend all four topics,” Atkins said. “Three of those areas are on the CFTC side, so we’ll let them worry about that, and we’ll focus on tokenized securities.” The development could mark a significant boon for companies seeking to raise capital by creating and selling tokens to investors and the public. Most ICOs could escape SEC oversight under new taxonomy ICOs were all the rage during the crypto boom of 2017—until the SEC, during President Donald Trump’s first term in office, poured cold water on the lucrative fundraising mechanism by suing numerous ICO issuers because they were selling illegally unregistered securities Atkins’ remarks on Tuesday imply the trend could regain popularity, with or without a crypto market structure bill . Under the SEC chair’s proposed taxonomy, the majority of crypto tokens would fall outside the agency’s regulatory scope. Instead, they would likely be overseen by the more lenient CFTC, along with numerous similarly structured ICOs, according to Atkins. Atkins’ strategy also recasts the old fight between the SEC and the Commodity Futures Trading Commission over jurisdiction. Because most tokens fall under the jurisdiction of the CFTC, an agency with a lighter enforcement footprint, the proposal may further weaken the SEC’s central role in crypto regulation. Some legal experts argue that the move reflects broader congressional efforts to empower the CFTC to lead the charge in regulating digital commodities within a regulatory environment more akin to how cryptocurrencies are being regulated in the UK and certain parts of Asia. Tokens that Atkins has indicated should not be classified as securities include those connected to decentralized blockchain networks, tokens tied to “internet memes, characters, current events, or trends,” and tokens that serve a practical purpose, such as tickets or memberships. Tokens that are associated with decentralized networks, internet culture, or practical utilities — say, tickets or memberships — could, therefore, be eligible for ICOs. Atkins noted in July that the SEC’s “Project Crypto” initiative could also support ICO activity through exemptions and safe harbors. The Senate is still debating a market structure bill, but industry players appear to be advancing. Last month, Coinbase launched a new ICO platform following its $375 million acquisition of Echo , enabling U.S. retail investors to access newly created tokens. Claim your free seat in an exclusive crypto trading community - limited to 1,000 members.

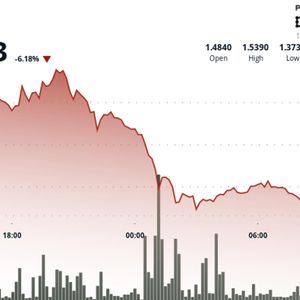

![[LIVE] Bitcoin Price Watch: Initial Jobless Claims Jump to 236K vs 220K Expected — Does Weak Labor Support Rate Cuts? [LIVE] Bitcoin Price Watch: Initial Jobless Claims Jump to 236K vs 220K Expected — Does Weak Labor Support Rate Cuts?](https://resources.cryptocompare.com/news/52/55644525.jpeg)