BitcoinWorld Stunning Revelation: 124 Cryptocurrency ETFs Await Regulatory Approval The landscape of digital asset investing is on the brink of a monumental shift. According to a stunning revelation from Bloomberg ETF analyst Eric Balchunas, a staggering 124 cryptocurrency ETFs are currently in the regulatory pipeline awaiting approval. This massive queue signals a tidal wave of institutional interest poised to hit the market, fundamentally changing how investors access digital currencies. What Does This Wave of Cryptocurrency ETFs Mean for Investors? This unprecedented number of pending applications represents more than just paperwork. It reflects a powerful, sustained demand from financial institutions to offer regulated, accessible products. For the everyday investor, the approval of these cryptocurrency ETFs would mean easier, safer, and more familiar avenues to gain exposure to crypto assets, often directly through their existing brokerage accounts. This move could dramatically accelerate mainstream adoption. Which Cryptocurrencies Lead the ETF Race? Balchunas’s breakdown reveals a fascinating hierarchy within the application queue. The lineup is not random; it highlights which assets the financial world is most eager to package for the public. The leaders are: Bitcoin (BTC): Leading the pack with 21 proposed funds, reinforcing its status as the flagship digital asset. Mixed-Asset Funds: Following with 15 applications, these ETFs would bundle multiple cryptocurrencies, offering instant diversification. XRP: A notable contender with 10 pending ETF applications, indicating strong institutional confidence despite past regulatory challenges. Solana (SOL): With nine funds in line, it underscores Solana’s growing prominence as a high-speed blockchain platform. Ethereum (ETH): Has seven applications awaiting review, cementing its role as the leading platform for decentralized applications. What Are the Key Challenges for Approval? However, the path from application to approval is fraught with hurdles. Regulatory bodies, particularly the U.S. Securities and Exchange Commission (SEC), have been cautious. Their primary concerns revolve around market manipulation, custody of assets, and investor protection. Each of these 124 cryptocurrency ETFs must convincingly address these issues. The recent approvals of spot Bitcoin ETFs have set a crucial precedent, but the process for other assets remains rigorous and uncertain. How Will Cryptocurrency ETFs Transform the Market? The potential impact of this ETF wave is profound. First, it would provide a massive influx of institutional capital, potentially bringing stability and liquidity to often-volatile markets. Second, it legitimizes the underlying assets in the eyes of traditional finance. Finally, it simplifies the investment process, removing technical barriers like managing private keys. This could unlock participation from a vast pool of retail investors who have been hesitant to use crypto exchanges. Conclusion: A New Era of Access is on the Horizon The queue of 124 cryptocurrency ETFs is a powerful indicator of the financial industry’s future direction. While not all will secure approval, the sheer volume demonstrates an irreversible trend toward the integration of digital assets into conventional portfolios. For investors, this pending wave represents a future of greater choice, improved security, and simplified access to the transformative world of cryptocurrency. Frequently Asked Questions (FAQs) Q: What exactly is a cryptocurrency ETF? A: A cryptocurrency ETF (Exchange-Traded Fund) is a regulated investment fund that tracks the price of one or more digital currencies. It trades on traditional stock exchanges, allowing investors to buy and sell shares without directly holding the underlying crypto. Q: Why are so many cryptocurrency ETFs awaiting approval now? A: The successful launch of spot Bitcoin ETFs in early 2024 proved there is massive investor demand and established a regulatory framework. This has encouraged asset managers to file applications for a wider range of crypto assets, hoping to replicate that success. Q: Does an ETF application guarantee approval? A> No. An application is just the first step. Regulators like the SEC conduct a detailed review that can take months or years. They can approve, deny, or delay decisions based on their assessment of market safety and investor protection. Q: How would a cryptocurrency ETF benefit a regular investor? A> It offers a familiar, regulated way to invest. You can buy shares through your standard brokerage account (like you would for stocks), benefit from professional custody of the assets, and avoid the complexity of setting up and securing a crypto wallet. Q: Are cryptocurrency ETFs safer than buying crypto directly? A> They offer different types of safety. ETFs provide regulatory oversight and institutional custody, reducing risks like exchange hacks or losing your private key. However, you still bear the market risk of the underlying asset’s price fluctuating. Did you find this insight into the future of crypto investing valuable? Share this article with your network on Twitter or LinkedIn to spark a conversation about the coming wave of digital asset access! To learn more about the latest cryptocurrency market trends, explore our article on key developments shaping Bitcoin and Ethereum institutional adoption. This post Stunning Revelation: 124 Cryptocurrency ETFs Await Regulatory Approval first appeared on BitcoinWorld .

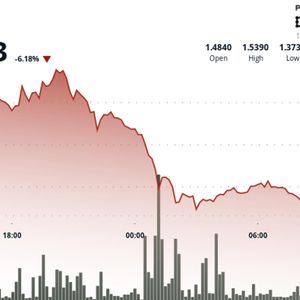

![[LIVE] Bitcoin Price Watch: Initial Jobless Claims Jump to 236K vs 220K Expected — Does Weak Labor Support Rate Cuts? [LIVE] Bitcoin Price Watch: Initial Jobless Claims Jump to 236K vs 220K Expected — Does Weak Labor Support Rate Cuts?](https://resources.cryptocompare.com/news/52/55644525.jpeg)