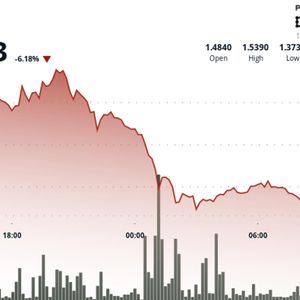

The cryptocurrency market continues to witness volatility, with notable capital outflows invalidating the recent bullish momentum. To this end, the global market shed roughly $100 billion in the past 24 hours, with total capitalization falling from about $3.15 trillion to $3.05 trillion as a wave of liquidation pressure and weakening investor appetite triggered a broad downturn. Total crypto market cap 30-day chart. Source: CoinMarketCap The pullback was led by Bitcoin ( BTC ), which slipped below $90,000 this week after failing to hold the $94,000–$95,000 range. The move marks its second major breakdown this month and erased gains from earlier recovery attempts. As of press time, Bitcoin dropped 1.77% to $89,614, Ethereum ( ETH ) fell 3.14% to $3,031, and BNB dipped 0.93% to $884.76. XRP slid 1.75% to $2.03, while Solana ( SOL ) recorded one of the steepest declines, falling 2.91% to $132.81. Top cryptocurrencies’ performance. Source: Finbold Why crypto market is tumbling The overall market decline was driven primarily by a cascade of forced liquidations. Nearly $500 million in leveraged positions were wiped out across major exchanges, including roughly $420 million in longs. More than 140,000 traders were liquidated within a single day, accelerating the downturn. Weaker ETF demand added to the pressure with BlackRock’s iShares Bitcoin Trust having now logged six consecutive weeks of outflows totaling more than $2.8 billion, while overall US spot Bitcoin ETF inflows dropped to just $59 million on December 3, signaling softening institutional interest at a critical moment. At the same time, macro conditions deepened the volatility. The Bank of Japan hinted at a possible rate hike, a shift that threatens carry-trade liquidity supporting global risk assets. Additionally, traders moved to reduce exposure ahead of the latest US PCE inflation report, keeping Bitcoin locked in a cautious $91,000–$95,000 range before the sell-off intensified. Although the PCE data arrived broadly in line with expectations, showing cooling but still elevated core inflation, the reading was not convincing enough for markets to assume faster Fed rate cuts. The result was a guarded reaction that reinforced risk-off behavior across crypto. Featured image via Shutterstock The post Crypto market just wiped out $100 billion appeared first on Finbold .

![[LIVE] Bitcoin Price Watch: Initial Jobless Claims Jump to 236K vs 220K Expected — Does Weak Labor Support Rate Cuts? [LIVE] Bitcoin Price Watch: Initial Jobless Claims Jump to 236K vs 220K Expected — Does Weak Labor Support Rate Cuts?](https://resources.cryptocompare.com/news/52/55644525.jpeg)