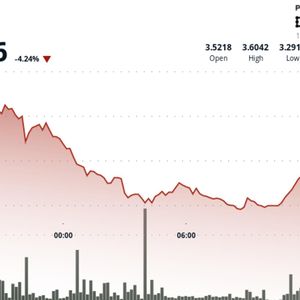

The U.S. Federal Reserve just delivered its third straight rate cut, and markets are already buzzing about what it could mean for risk assets, especially crypto. With Chair Jerome Powell signaling that inflation pressures may ease as growth returns, some analysts are turning their attention to the Bitcoin price prediction , suggesting that falling rates could help ignite a 2026 crypto supercycle. Industry Leaders Predict 2026 Bitcoin Supercycle On Wednesday, the Fed reduced its benchmark rate by 25 basis points to 3.50%. While markets anticipated the move, the 9–3 split vote on the Federal Open Market Committee and Powell’s hawkish tone during the press conference dampened crypto sentiment . Despite short-term concerns, crypto analysts argue that broader economic conditions continue supporting long-term digital asset adoption. “Crypto is going to have a massive catch-up trade into Q1 2026." Liquidity is back , breadth is expanding , and risk assets are primed. #Crypto won’t just benefit, it’ll EXPLODE. pic.twitter.com/5zhavbqJnV — Coin Bureau (@coinbureau) August 23, 2025 Liquidity conditions are projected to gradually strengthen into 2026, while business-cycle indicators show ongoing stabilization. Raoul Pal, CEO of Real Vision and Global Macro Investor, stated the traditional crypto 4-year cycle has evolved into a 5-year pattern, with Bitcoin positioned for a supercycle throughout 2026. Fundstrat CIO Tom Lee believes Bitcoin is entering a “supercycle” driven by the current business cycle and ISM readings above 50. “New highs come early. Like in January,” he forecasted. At the recently concluded Bitcoin MENA Conference in Abu Dhabi, Binance founder Changpeng Zhao echoed this sentiment, suggesting a crypto supercycle could materialize in 2026. The Bitcoin Power Curve Cycle Cloud indicator now projects a peak around $250,000 in 2026. Bitcoin Price Prediction: $88K Support Crucial For BTC Rally In the near term, technical analysis reveals Bitcoin is struggling to breach the $94,000 resistance zone, marking the third rejection at this level in December. The entire pre-FOMC rally has been completely reversed. The sharp selloff pushed price back into the $90,000–$89,000 range, applying immediate pressure on the critical $88,000 support level highlighted on charts. This level has repeatedly functioned as a defensive barrier; breaking below it would trigger a deeper correction toward lower liquidity zones around $84,000–$80,000. Source: TradingView Momentum has deteriorated as the RSI rolls over from near-neutral territory, indicating weakening strength following the rejection. Currently, price action tilts bearish unless Bitcoin reclaims $92,000 and stabilizes above it. Maintaining $88,000 preserves the overall structure, but breaking below that threshold increases the risk of a sharper decline toward sub-$80,000 levels. New Doge-Themed Meme Coin Raises $4.3M Fast – Next 100x? As Bitcoin tries to bottom before the anticipated 2026 supercycle rally, early-stage projects like Maxi Doge ($MAXI) are attracting investors seeking to capitalize on the coming liquidity wave. Drawing inspiration from Dogecoin’s 2021 supercycle rally, $MAXI is creating an energetic community where traders exchange exclusive information, early trade setups , and undiscovered opportunities before they gain mainstream attention. The $MAXI presale has now generated over $4.3 million and represents one of the cycle’s most accessible, community-focused opportunities. Early supporters still have time to participate before the next price increase and before the 72% APY staking rewards decrease. To purchase early, visit the official Maxi Doge website and connect a crypto wallet like Best Wallet . You can pay using popular crypto like USDT and ETH, or use a bank card to complete your purchase instantly. Visit the Official Maxi Doge Website Here The post Bitcoin Price Prediction: US Fed Cuts Rates for the Third Time – Is This the Trigger for a 2026 Crypto Supercycle? appeared first on Cryptonews .