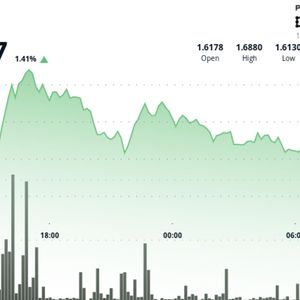

Bitcoin is drawing attention from both regulators and traders as a proposed “after dark” ETF targets its overnight gains while the spot price presses into the $92,000–$94,000 resistance zone. The filing and the chart setup now frame the next move, as markets watch whether Bitcoin can break higher toward $100,000 or slip back toward support. Bitcoin ‘After Dark’ ETF Filing Targets Overnight Price Gains A new filing confirms plans for an exchange-traded fund designed to hold Bitcoin only at night. The proposal, submitted by Tidal Trust II for the Nicholas Bitcoin and Treasuries AfterDark ETF, outlines a strategy that buys Bitcoin exposure at the U.S. market close and sells it shortly after the opening bell. The document says the fund will enter Bitcoin positions around 4 p.m. Eastern time. Then, it will unwind those positions after 9:30 a.m., limiting exposure to the overnight window. During daytime trading hours, the ETF plans to keep assets in short-term U.S. Treasuries, money-market funds and cash equivalents. The issuer cites data showing that much of Bitcoin’s historical upside has occurred outside regular U.S. stock-market hours. Because of that pattern, the fund aims to capture those overnight moves while avoiding daytime volatility. The filing shows that the strategy remains a proposal and still requires approval from the Securities and Exchange Commission. Bitcoin Tests $92K–$94K Resistance as Trader Maps Next Levels Bitcoin has returned to a key resistance band between $92,000 and $94,000, according to a chart shared by trader Ted, who posts as @TedPillows on X. The daily chart shows price pressing into that zone after bouncing from support below $90,000. Bitcoin Resistance At 92K To 94K. Source: TedPillows on X In his post, Ted said a clean move above this resistance could open the way for a rally toward $100,000. The chart outlines an upside path with successive higher highs if buyers push through the band and hold above it. However, Ted also warned that a failure at this level would likely send Bitcoin back to retest the $90,000 area. The downside scenario on the chart shows another rejection from resistance followed by a drop toward lower support if sellers regain control.