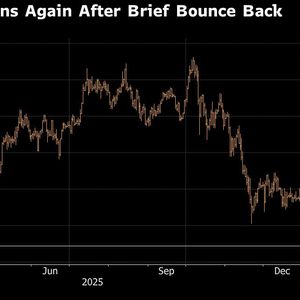

BitcoinWorld Bitcoin Price Analysis: Expert Warns of Potential Plunge to $58,000 Amid Mounting Pressure NEW YORK, March 2025 – The cryptocurrency market faces renewed scrutiny as a leading analyst projects a significant potential downturn for Bitcoin. Alex Thorn, head of research at Galaxy Digital, recently outlined a scenario where Bitcoin’s price could test the $58,000 level. This analysis follows Bitcoin’s breakdown of key technical support, triggering substantial market liquidations and raising concerns about medium-term trajectory. Consequently, investors and traders are closely monitoring on-chain metrics and macroeconomic signals for directional clues. Bitcoin Price Analysis Points to Key $58,000 Level Alex Thorn’s assessment, shared via social media platform X, identifies the 200-week moving average near $58,000 as a critical potential target. This long-term technical indicator has historically acted as a major support zone during previous market cycles. Thorn’s prediction stems from a confluence of negative factors currently pressuring the market. Firstly, Bitcoin has already declined approximately 15% since late January. This drop precipitated over $2 billion in long position liquidations across derivatives exchanges, according to data from Coinglass. Such liquidations often exacerbate downward momentum by forcing the closure of leveraged bets. Furthermore, on-chain data reveals a troubling statistic: roughly 46% of the total Bitcoin supply is now held at a loss. Analysts frequently compare this metric to past bear market environments. For instance, during the 2022 crypto winter, similar supply-in-loss percentages preceded extended periods of price consolidation or decline. The current situation suggests a broad base of holders are underwater, which may increase selling pressure if prices fail to recover promptly. Understanding the Catalysts for Selling Pressure Thorn’s analysis cites three primary drivers for the potential continued weakness: weak on-chain data, macroeconomic uncertainty, and a lack of upward catalysts. On-chain activity, measured by metrics like active addresses and transaction volume, has shown stagnation. This stagnation indicates reduced network utility and speculative interest. Simultaneously, global macroeconomic conditions contribute to the uncertainty. Central bank policies, inflation data, and geopolitical tensions influence investor risk appetite across all asset classes, including cryptocurrencies. Notably, the market currently lacks a clear, positive catalyst to reverse the trend. The initial euphoria surrounding the approval of spot Bitcoin ETFs in the United States has largely subsided. While these funds continue to see inflows, their impact on price has diminished. Thorn suggests that without a new, powerful demand driver or a significant improvement in macroeconomic sentiment, selling pressure may persist. He does, however, acknowledge the possibility of temporary sideways movement. This consolidation could occur within a 10% range of the average spot BTC ETF purchase price, which analysts estimate near $84,000. The Role of Institutional Analysis in Crypto Markets Galaxy Digital’s research carries significant weight due to the firm’s established position in the digital asset ecosystem. As a publicly-traded cryptocurrency-focused financial services firm, its analysts have deep access to market data and institutional flows. Their reports often incorporate insights from trading desks, venture capital portfolios, and macroeconomic research. This institutional perspective provides a crucial counterpoint to retail-driven sentiment often found on social media. Therefore, Thorn’s warning serves as a data-backed assessment for a market frequently swayed by speculation. The current price action also reflects broader trends in the digital asset sector. Altcoins have typically shown even greater volatility, often magnifying Bitcoin’s moves. A sustained drop in Bitcoin’s price would likely pressure the entire cryptocurrency market capitalization. Market participants are now evaluating key support levels below the current price. The $58,000 figure represents not just a moving average but a psychological threshold that, if breached, could trigger another wave of risk-off behavior. Historical Context and Market Cycle Comparisons Examining past Bitcoin cycles offers valuable context for the current prediction. The 200-week moving average has played a pivotal role in several major market bottoms. For example, during the 2018-2019 bear market, Bitcoin price found a long-term floor at this indicator. Similarly, in 2022, the price revisited this zone before beginning its subsequent recovery. A return to this level in 2025 would align with historical patterns of deep retracements within bull markets. However, each cycle possesses unique characteristics. The introduction of spot ETFs represents a fundamental shift in market structure. These products provide a regulated, accessible conduit for traditional capital. Their sustained inflows or outflows now represent a new form of demand and supply. The “average purchase price” for these ETFs becomes a relevant metric for large-scale support or resistance. If the price remains below this average for an extended period, it could indicate that institutional buying interest is waning. The table below summarizes key differences between the current environment and previous cycles. Market Factor Previous Cycles (e.g., 2020-2021) Current 2025 Cycle Context Institutional Access Limited; via futures ETFs or direct custody. Broad; via multiple spot Bitcoin ETFs in the US. Macro Environment Extremely low interest rates, quantitative easing. Higher for longer rate potential, quantitative tightening. On-chain Metrics Strong growth in active addresses and hash rate. Mature network with slowing growth in some metrics. Regulatory Clarity Low; significant uncertainty. Improving but still evolving, especially globally. These structural differences mean historical price patterns may not repeat exactly. Nevertheless, technical analysis tools like moving averages remain widely followed by both retail and institutional traders. Their collective belief in these levels can become a self-fulfilling prophecy as buy and sell orders cluster around them. Conclusion In conclusion, the Bitcoin price analysis from Galaxy Digital highlights a cautious outlook for the premier cryptocurrency. The convergence of technical breakdown, weak on-chain fundamentals, and a challenging macroeconomic backdrop presents clear headwinds. The $58,000 level, defined by the 200-week moving average, emerges as a critical zone to watch in the coming weeks and months. While temporary consolidation is possible, the absence of a strong positive catalyst suggests the path of least resistance may be lower. Market participants should monitor ETF flow data, macroeconomic announcements, and Bitcoin’s ability to hold key support levels. This Bitcoin price analysis underscores the importance of risk management and a long-term perspective in a volatile asset class. FAQs Q1: What is the 200-week moving average and why is $58,000 significant? The 200-week moving average is a long-term technical indicator that smooths out Bitcoin’s price data over 200 weeks (nearly 4 years). It has historically acted as major support during bear markets. Analyst Alex Thorn identifies it near $58,000 as a potential target if current selling pressure continues. Q2: What does “46% of Bitcoin supply at a loss” mean? This on-chain metric indicates that nearly half of all existing Bitcoin was last moved at a price higher than the current market price. These holders are currently sitting on unrealized losses. A high percentage can signal broad market stress and potential selling pressure if holders capitulate. Q3: How did the spot Bitcoin ETF approvals affect this analysis? The ETF approvals in early 2024 provided a massive upward catalyst. However, that bullish effect has dissipated. The analysis now focuses on the lack of a new catalyst to drive demand, with the average ETF purchase price (~$84,000) now acting as a potential resistance area. Q4: What are the main reasons for the predicted selling pressure? Thorn cites three core reasons: 1) Weak on-chain data showing reduced network activity, 2) Growing macroeconomic uncertainty affecting risk assets, and 3) A lack of new, positive catalysts to drive investor enthusiasm and fresh capital inflows. Q5: Is this prediction a certainty? No, this is an analysis of potential risk based on current data. Financial markets are unpredictable. The analysis outlines a plausible scenario if current conditions persist, but unexpected positive news or shifts in macro policy could alter the trajectory. It serves as a warning for risk assessment, not a guaranteed forecast. This post Bitcoin Price Analysis: Expert Warns of Potential Plunge to $58,000 Amid Mounting Pressure first appeared on BitcoinWorld .