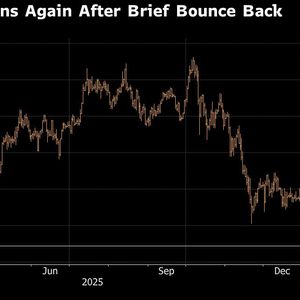

Bitcoin sentiment has plunged to extreme fear levels, and it’s now time for traders to prepare for further market declines, especially after weeks of falling prices and liquidations. As seen in the latest data from the Crypto Fear and Greed Index, the indicator is at 14 and in the “extreme fear” zone. Fear is spreading across the market as more people rush to sell Bitcoin Bitcoin prices have been declining over the last month, making many investors anxious . The prices have dropped by 13% over the last 30 days, making it the fourth consecutive month of decline for the cryptocurrency. The decline is similar to last year, when prices dropped steadily, and investor sentiment weakened. The decline in prices over the weekend heightened concerns, especially after they dropped to $74,500, a level not seen since before $80,000. Many traders closed their positions, and prices only recovered to $78,500. As prices declined, losses quickly cascaded through the derivatives market . In just 24 hours, more than $2.2 billion in leveraged crypto positions were liquidated. Long traders had to sell their assets as prices fell to meet margin calls, further fueling the decline. Traders immediately reduced risk due to apprehensions about tariffs, economic conditions, and other issues in the global market. Investors are not only withdrawing from cryptocurrencies but also from other risky investments. Not even safe assets in hard times have been able to save investors. Gold declined 12 percent in a single day, and silver fell 30 percent as investors quickly shifted away from risk. The Crypto Fear & Greed Index has remained in extreme fear for a while now, at 14, unchanged from the previous day. This level is much lower than last month’s 29. These signals include price movements, trading volume, social media, market share, and search trends. All these factors indicate a market that is being cautious and defensive, not one that is confident or willing to take risks. The charts warn traders that Bitcoin could fall even lower Traders are being very cautious as prices continue to fall. Although there was a bit of a bounce after the weekend selloff, people are not seeing this as a sign that the market has reversed. This is also confirmed by the technical indicators, which suggest that selling pressure will remain strong. The trend indicators also show that short-term confidence is still not back. The 50-day exponential moving average is below the 200-day moving average. The Average Directional Index is above 30 on the daily chart and above 57 on the four-hourly chart, indicating that markets are moving with conviction. In this case, the markets are moving downwards. At the same time, the momentum indicators suggest the selling might be overdone. The Relative Strength Index has fallen to 30, indicating that the market is oversold. This does not necessarily mean that a trend reversal is underway. The fact that Bitcoin has risen from around $74,500 implies that buyers are defending that level, but the recent price action has been unfavorable, with gains unable to sustain, suggesting that confidence remains low. If Bitcoin fails to sustain above this level the next time it’s tested, it’s assumed that if the price goes below $74,000, the next significant level, which will be targeted for the next potential decline, will be $69,000. The change in market sentiment can also be seen from prediction markets, where currently, the odds are at 67.9% that Bitcoin will fall to $69,000 before rallying to $100,000, a significant change from just two weeks ago, when predictions were pointing towards another rally. On a positive note, the road to recovery remains narrow, with the cryptocurrency seen facing initial resistance at $80,600, followed by a significant level at $91,350, before a recovery rally can be initiated. Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.