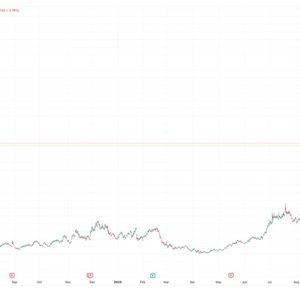

Strategy, the world’s biggest corporate stockpiler of Bitcoin, is engaging with MSCI about a decision that could potentially exclude it from its indices. The company risks exclusion from MSCI indices due to its volatile balance sheet. According to reports , Chairman Michael Saylor is directly engaging MSCI ahead of its January 15, 2026, decision. JP Morgan warned that an exclusion would cast doubts on the company’s costs and ability to raise equity and debt in the future. Saylor cites JP Morgan’s numbers on the outflows as incorrect Strategy is currently part of the MSCI USA and MSCI World indices. A significant portion of its market value is tied to benchmarks through passive investment vehicles, such as ETFs. Bitcoin’s recent 10% price drop has intensified pressure on MSTR shares, which trade at a 2.5x premium to its crypto assets, serving as a leveraged Bitcoin proxy. As a result, JPM said , “In light of MSCI’s decision to consider removing MicroStrategy and other digital-asset treasury companies from its equity indices, potential outflows could reach $2.8bn if MicroStrategy is removed from MSCI indices. Should other index providers adopt this practice, cumulative outflows across all equity indices could total $8.8bn.” In response, Saylor stated that he was unsure whether JPMorgan’s numbers on the outflows were correct. Investors have also criticized JPM’s metrics. According to them, JPM intends to mount a coordinated attack against Strategy. Additionally, users noted that in July, JPMorgan tightened margin requirements on loans backed by MSTR shares. In their view, that was when Strategy’s problems began. “The equity is going to be volatile because the company is built on amplified bitcoin. If bitcoin falls, you know, if it falls 30%, 40% then the equity is going to fall more, because the equity is built to fall,” Saylor stated. The recent decline in the price of the king coin was driven by increased caution over riskier assets, spurred by the specter of an AI bubble amid lofty tech valuations and overall economic uncertainty, which has soured the rally in recent weeks. Meanwhile, the coin is up 6.5% in the last 24 hours, now trading at $92,998. Strategy FUD projects losses of up to $5.5 billion in 2025 Strategy’s stock has fallen 60% since hitting a record high in July, bringing its market cap very close to the value of its Bitcoin. They are also down over 37% this year. As a result, the value of Saylor’s company has also plunged. Strategy warned on Monday that it would suffer a loss of $5.5 billion in 2025 if the price of Bitcoin did not recover before the end of the year. As reported by Cryptopolitan, the Nasdaq-listed company also announced that it had sold some of its assets to set up a $1.44 billion cash reserve to pay its dividends on its preferred stock and interest on its outstanding debt. It also updated its 2025 earnings guidance, assuming a lower year-end price for Bitcoin of $85,000 to $110,000. The company previously set guidance indicating that Bitcoin would be around $150,000 by the end of the year. According to Saylor, the plan will better position the company to navigate short-term market volatility. However, analysts see it as a move designed to stop a panic sale of its stock. Still, Strategy’s share price has continued to decline by as much as 12.2% on Monday after the statement. During the worst of its slump, the company’s market cap was worth $10 billion less than its net Bitcoin holdings. “My hope is our mNAV doesn’t go below one, but if we did and we didn’t have access to other capital, we would sell bitcoin There’s the mathematical side of me that says that would be the absolutely right thing to do,” Sayor stated Meanwhile, the company continues to accumulate more Bitcoin. On Monday, it announced that it bought 130 more Bitcoin, boosting its stockpile to 650,000, valued at roughly $59 billion based on recent prices. Join Bybit now and claim a $50 bonus in minutes