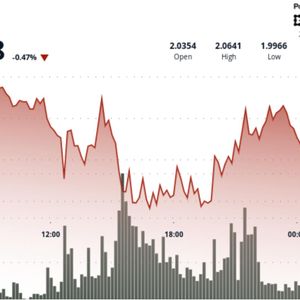

BitcoinWorld Shocking Reversal: US Spot ETH ETFs Bleed $79M, Ending 5-Day Inflow Streak The recent rally in US spot ETH ETFs hit a sudden wall. On December 1st, these funds experienced a shocking net outflow of $79.13 million, abruptly ending a promising five-day streak of positive inflows. This dramatic shift, reported by TraderT, signals a potential change in short-term investor sentiment toward Ethereum-based exchange-traded products. Let’s break down what happened and why it matters for your crypto portfolio. What Caused the US Spot ETH ETFs Outflow? The outflow wasn’t a uniform sell-off. Instead, it was driven by specific major funds. Grayscale’s Ethereum Trust (ETHE) led the retreat with a substantial $49.79 million exit. Fidelity’s Ethereum Fund (FETH) followed, seeing $31.62 million leave. Furthermore, the Grayscale Ethereum Mini Trust contributed an additional $20.28 million to the total outflow. This coordinated movement suggests a segment of institutional or large-scale investors decided to take profits or reallocate capital simultaneously. Was There Any Positive Movement in US Spot ETH ETFs? Yes, a significant counter-trend provided a silver lining. While other funds bled assets, BlackRock’s iShares Ethereum Trust (ETHA) stood out. It attracted $26.59 million in net inflows, partially offsetting the broader negative trend. This indicates that investor confidence is not universally shaken. Some capital is simply rotating between different fund providers, possibly based on fees, perceived security, or brand trust. This divergence highlights a key market dynamic: not all US spot ETH ETFs are created equal in the eyes of investors. The flow data reveals a competitive landscape where: Grayscale’s products faced significant redemption pressure. BlackRock’s fund demonstrated relative strength and appeal. The overall market for US spot ETH ETFs remains fluid and sensitive to daily sentiment. What Does This Mean for Ethereum Investors? A single day of outflows for US spot ETH ETFs does not necessarily forecast a long-term bear trend. However, it serves as a crucial reality check. The five-day inflow streak showed growing appetite, but this reversal proves that appetite can wane quickly. For Ethereum investors, this underscores the importance of monitoring fund flow data as a pulse check on institutional sentiment. These flows can indirectly influence Ethereum’s market price by affecting the underlying buying and selling pressure required by the ETF issuers. Therefore, tracking the weekly performance of US spot ETH ETFs becomes an essential tool for understanding broader market forces beyond retail trading on exchanges. Key Takeaways from the ETF Flow Data To summarize the event’s implications: Volatility is inherent: ETF flows, like crypto prices, can be highly volatile. Watch the leaders: Movements in giant funds like Grayscale’s ETHE often set the tone. Rotation is key: Money moving between funds (e.g., from Grayscale to BlackRock) is different from money leaving the asset class entirely. Context matters: One day’s data is a snapshot, not the full movie. The trend for US spot ETH ETFs over the coming weeks will be more telling. In conclusion, the $79 million outflow is a stark reminder that the path toward mainstream adoption for crypto investment vehicles like US spot ETH ETFs will be punctuated by periods of profit-taking and sentiment shifts. For the savvy investor, this data is not a signal to panic, but rather a valuable piece of the puzzle in assessing market health and making informed decisions. Frequently Asked Questions (FAQs) Q1: What are US spot ETH ETFs? A1: US spot ETH ETFs are exchange-traded funds that hold actual Ethereum (ETH). They trade on traditional stock exchanges, allowing investors to gain exposure to Ethereum’s price without directly buying or storing the cryptocurrency. Q2: Why do ETF flows matter for Ethereum’s price? A2: When an ETF sees large inflows, the issuer must buy more ETH to back the new shares, creating buying pressure. Large outflows force the issuer to sell ETH, creating selling pressure. This can influence the asset’s market price. Q3: Is a single day of outflow a major concern? A3: Not necessarily. It breaks a positive streak, which is noteworthy, but the long-term trend is more important. Market sentiment often shifts daily based on broader financial conditions. Q4: Which US spot ETH ETF performed best on Dec. 1? A4: BlackRock’s iShares Ethereum Trust (ETHA) was the sole major fund with net inflows, attracting $26.59 million while others saw outflows. Q5: Where can I track this flow data? A5: Data is reported by firms like TraderT, Farside Investors, and various crypto analytics platforms. Financial news websites covering cryptocurrency often summarize these figures daily or weekly. Q6: Should I sell my Ethereum because of this ETF outflow? A6: Investment decisions should be based on your long-term strategy and risk tolerance, not a single day’s data. This outflow is one indicator among many to consider. Found this analysis of US spot ETH ETFs helpful? Share this article with your network on Twitter or LinkedIn to discuss what these market flows mean for the future of crypto investing. To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum institutional adoption. This post Shocking Reversal: US Spot ETH ETFs Bleed $79M, Ending 5-Day Inflow Streak first appeared on BitcoinWorld .