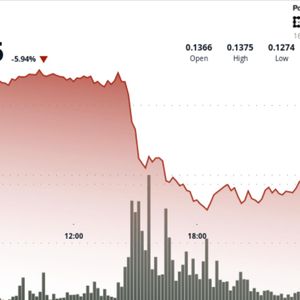

BitcoinWorld Digital Asset Funds Achieve Stunning $864M Inflow Streak: Cautious Optimism Returns For the third week in a row, a significant wave of capital has flowed into cryptocurrency markets. According to the latest data from CoinShares, digital asset funds recorded a substantial $864 million in net inflows. This consistent positive movement suggests a shifting sentiment among institutional and sophisticated investors, moving from fear to a more measured optimism. But what’s driving this trend, and is the confidence here to stay? What Do the Digital Asset Fund Inflows Reveal? CoinShares’ weekly fund flow report provides a clear snapshot of institutional sentiment. The $864 million figure isn’t just a number; it represents a sustained vote of confidence. The firm notes that while the volume has been ‘modest’ over these three weeks, it points to an investment base that is ‘cautiously more optimistic.’ This is a crucial shift from the outflows and uncertainty that have characterized other periods. However, the path hasn’t been perfectly smooth. CoinShares observed that investor sentiment was mixed following the recent U.S. Federal Reserve interest rate cut, leading to erratic fund flows in the immediate trading days. This tells us that while the trend is positive, the market remains sensitive to macroeconomic signals. Breaking Down the $864 Million: Bitcoin and Ethereum Lead Where exactly is this money going? The inflows are heavily concentrated in the two largest cryptocurrencies: Bitcoin Investment Products: Attracted the lion’s share with $522 million in inflows. This underscores Bitcoin’s continued role as the primary gateway for institutional exposure to crypto. Ethereum Products: Saw a strong $338 million influx. This significant figure highlights growing institutional interest in Ethereum’s ecosystem beyond just a store of value. This distribution shows that confidence is building across the core of the crypto market, not isolated to a single asset. Why Are Digital Asset Funds Seeing This Inflow Streak? Several factors could be contributing to this three-week surge. First, after periods of consolidation or decline, prices often attract investors looking for entry points. Second, the broader narrative around institutional adoption, including spot Bitcoin ETF developments, continues to build a long-term case. Finally, the ‘cautious optimism’ noted by CoinShares may stem from a perception that some macroeconomic headwinds are being priced in, making digital assets look relatively attractive. The key challenge for this trend is sustainability. Can inflows continue if traditional markets face renewed volatility? The reaction to the Fed’s rate cut shows that crypto hasn’t fully decoupled from macroeconomics. Actionable Insights for Observers What does this mean for you? For investors and market watchers, these flows are a critical sentiment indicator to monitor. Watch the Trend: A fourth week of inflows would significantly strengthen the bullish signal for digital asset funds . Look Beyond Headlines: Pay attention to flow data for smaller altcoins to gauge if optimism is spreading. Context is Key: Always weigh fund flow data against broader market news and price action. The Bottom Line on Sustained Fund Inflows The third consecutive week of positive flows into digital asset funds is a compelling development. It moves beyond a one-off event to suggest a genuine, though careful, rebuilding of institutional interest. While the shadow of macroeconomic policy remains, the consistent allocation of capital to Bitcoin and Ethereum paints a picture of growing foundational strength. The market appears to be patiently accumulating, betting on the long-term digital future. Frequently Asked Questions (FAQs) What are ‘digital asset investment products’? These are regulated financial vehicles, like exchange-traded products (ETPs) or trusts, that allow investors to gain exposure to cryptocurrencies like Bitcoin without directly buying and storing the assets themselves. Why is a third week of inflows so important? In finance, trends are more significant than single events. Three consecutive weeks suggest a sustained shift in sentiment rather than a temporary reaction, indicating stronger conviction among investors. Does this mean the crypto bull market is back? While very positive, sustained inflows are one indicator among many. They show increasing demand but should be considered alongside price trends, trading volume, and broader economic conditions. How does the Federal Reserve impact digital asset funds? Interest rate decisions influence the entire investment landscape. Lower rates can make riskier assets like cryptocurrencies more attractive, but the relationship is complex and often leads to short-term volatility, as seen recently. Where can I find this fund flow data? Research firms like CoinShares publish weekly reports. Many financial news websites also summarize the key findings, providing an accessible way to track this institutional data. Should I invest based on this inflow data? This data is a useful tool for understanding market sentiment, but it should not be your sole reason for investing. Always conduct your own research, consider your risk tolerance, and if needed, consult with a qualified financial advisor. Found this breakdown of the latest digital asset funds trend helpful? Share this article with your network on Twitter or LinkedIn to spark a conversation about where institutional money is flowing next in crypto. To learn more about the latest cryptocurrency market trends, explore our article on key developments shaping Bitcoin and Ethereum price action and institutional adoption. This post Digital Asset Funds Achieve Stunning $864M Inflow Streak: Cautious Optimism Returns first appeared on BitcoinWorld .