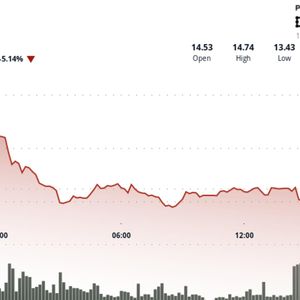

SpaceX and BlackRock recently shifted more than $296 million in Bitcoin (BTC) to Coinbase Prime, according to on-chain trackers at Lookonchain. The large transfers landed just hours before the U.S. Federal Reserve confirmed a 25-basis-point rate cut, adding fresh tension to an already shaky market. The timing has drawn traders into a debate over whether these moves signal strategic custody changes or preparations to sell amid heightened volatility. Fresh Transfers Raise Questions as Fed Decision Hits Markets According to Lookonchain, SpaceX moved another 1,021 BTC, worth around $94 million, to a Coinbase Prime-linked address on December 10, continuing a pattern of weekly transfers near the $100 million mark over the past two months. The firm had shifted 1,083 BTC five days earlier, following a series of similar transactions stretching back to October. BlackRock made an even larger move, depositing 2,196 BTC valued at about $203 million to Coinbase Prime within the same 24-hour window. Social media reaction split quickly. Some market watchers, like Ted Pillows, worried that it signaled “more selling,” while others, such as 0xNobler, accused the asset manager of applying pressure ahead of the Fed announcement. At the same time, several bullish accounts highlighted that BlackRock’s ETF bought roughly $191 million in Bitcoin and $55 million in Ethereum (ETH), adding to the confusion about whether the firm is accumulating or trimming exposure. The SpaceX transfers also came amid intense speculation about the company’s future. As reported by Bloomberg, SpaceX is seen as a potential candidate for a historic initial public offering, with chatter about a Starlink spinoff and a staggering private valuation estimated at up to $1.5 trillion. Market Backdrop, Price Action, and What Comes Next The timing of these transfers has amplified market unease. They occurred just as the price of BTC experienced notable volatility, dropping from a brief spike above $94,500 on December 10 to around $90,000 at press time. Price ranges remain wide: BTC moved between $89,000 and $94,000 in the past 24 hours and between $88,000 and $94,000 across the past week, reflecting the unsettled atmosphere around monetary policy expectations. Furthermore, over the past month, the asset has fallen by more than 14%, lagging behind ETH and several top altcoins that saw stronger rebounds earlier in the week. Despite the turbulence, market structure may be steadier than headlines suggest. Coinbase Institutional recently noted that speculative positioning has cooled from summer levels, which they believe could support a more stable trend as December progresses. For now, the core question remains whether SpaceX and BlackRock’s transfers represent routine storage adjustments or preparations for liquidity events during an uncertain macro window. With BTC down more than 28% from its October all-time high and Fed policy still shaping sentiment, traders are watching the next wallet movements closely. The post SpaceX, BlackRock Shift $296M in Bitcoin: Sell-Off Signal Ahead? appeared first on CryptoPotato .