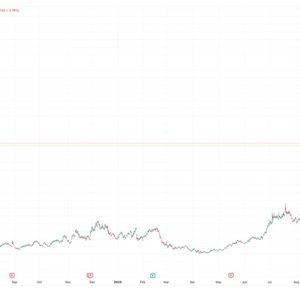

Strategy’s value now moves with a speed that surprises even long-time market watchers. As the company’s market cap jumps ahead of major banks and draws fresh attention from index providers, the stock is entering one of its most closely watched periods yet. Strategy’s Market Value Briefly Surpasses Standard Chartered Strategy Inc.’s market capitalization has climbed above that of Standard Chartered, marking a new milestone for the Bitcoin-focused company. The latest trading data shows Strategy valued at roughly 52 to 53 billion dollars, while Standard Chartered sits near 51 billion dollars in U.S.-dollar terms. The shift reflects Strategy’s continued rise as its Bitcoin holdings drive both investor attention and daily valuation changes. The company has expanded its reserves throughout the year, and each price swing in Bitcoin now moves its market cap in real time. As a result, Strategy’s value occasionally passes long-established financial institutions. Strategy MSTR Market Cap. Source: Yahoo Finance Standard Chartered’s market capitalization continues to fluctuate with currency changes and trading volumes on the London Stock Exchange. Because the gap between the two companies is narrow, their positions can switch during the day. However, the current figures confirm that Strategy has, at least briefly, overtaken the global banking group in size. Saylor Confirms Talks With MSCI Over Potential $MSTR Index Removal Michael Saylor said Strategy Inc. is in direct discussions with MSCI after reports emerged that the index provider may remove the company’s stock from some of its benchmarks. He confirmed the talks in an interview cited by Reuters, calling them part of an active review process now underway. MSCI’s review comes as Strategy’ s growing Bitcoin exposure raises questions about how closely it aligns with the criteria for traditional equity indices. JPMorgan analysts recently noted that MSCI could decide to exclude $MSTR from specific indexes as early as January. The move would affect funds and benchmarks that currently include the stock due to its strong performance and market cap. Saylor said Strategy is working to ensure the company remains eligible while addressing concerns raised by index officials. No final decision has been made yet, but the ongoing discussions confirm that MSCI is seriously evaluating the firm's place in its benchmarks. Trader Flags Key Support Zone as Strategy Stock Rebounds Meanwhile, an options trader says Strategy’s stock now shows a risk-reward profile that leans to the upside after a steep pullback. The shares have dropped more than 60 percent from highs in the mid-400s earlier this year and recently returned to the 150–160 dollar area that acted as a demand zone several times in 2024. Last week, price bounced from that region and pushed back toward 181 dollars while Bitcoin traded steady above 90,000 dollars. MSTR Weekly Chart Analysis. Source: EliteOptionsTrader on X The analysis highlights 185 dollars as a key level on the weekly chart. Price has rejected that zone multiple times, so a clean break and close above it would mark a shift in momentum. From there, the trader argues that an extension toward and above 200 dollars becomes possible if buyers keep control. The view also links Strategy’s next move to Bitcoin’s behavior. If BTC continues to hold above 90,000 dollars and starts reclaiming higher levels, the trader expects Strategy to react strongly because the stock looks oversold on the weekly timeframe. However, the setup still depends on Bitcoin staying firm and on Strategy defending the recent support band.