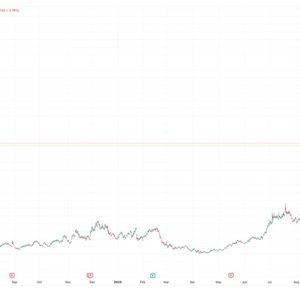

The U.S. Bureau of Labor Statistics releases September import and export price indexes at 8:30 AM ET today, with crypto markets watching closely for inflation signals that could shift expectations for a Federal Reserve rate cut. Bitcoin is trading around $93,000 after recovering from last week’s $88,500 crash , while the total crypto market cap sits at $3.3 trillion. Import prices recorded no change in September, while export prices were also unchanged, suggesting inflation pressures remain muted despite fuel price volatility. Markets are pricing in 88% odds of a December rate cut at the Fed’s December 9-10 meeting, and any signs of cooling price pressures in the data could reinforce dovish expectations and support risk assets, including crypto. Source: CME FedWatch Tool The September data shows nonfuel import prices rose 0.8% year-over-year while fuel imports fell 4.0%, with petroleum down 5.1% over the past 12 months. Higher prices for industrial supplies and consumer goods were offset by lower prices for capital goods and food. For crypto traders, the key takeaway is that inflation isn’t accelerating; import prices rose just 0.3% year over year in September, the first annual increase since March 2025. This supports the narrative that the Fed has room to continue cutting rates without reigniting inflation, which would be bullish for Bitcoin and altcoins as lower rates typically drive liquidity into risk assets. Technical indicators show Bitcoin needs to hold $94,000 support and break resistance at $98,000-$100,000 to confirm the uptrend. With QT officially ended December 1 and the Fed’s blackout period starting this week ahead of the December 9-10 meeting, today’s price data is one of the last major economic releases that could influence policy expectations. Subdued import prices combined with the Fed’s liquidity pivot create favorable conditions for crypto’s next leg higher, though traders should watch for any upside surprises in the data that could dampen rate cut odds. The post [LIVE] Bitcoin Price Alert: Can U.S. Import and Export Price Data Today Trigger Altcoin Recovery? appeared first on Cryptonews .

![[LIVE] Bitcoin Price Alert: Can U.S. Import and Export Price Data Today Trigger Altcoin Recovery? [LIVE] Bitcoin Price Alert: Can U.S. Import and Export Price Data Today Trigger Altcoin Recovery?](https://resources.cryptocompare.com/news/52/55301467.jpeg)