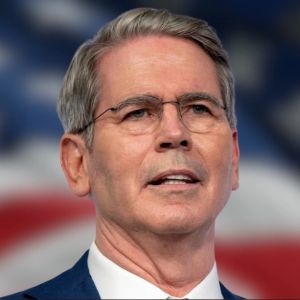

Scott Bessent, the U.S. Treasury Secretary, said China “made a real mistake” when it tried to use its grip on rare earths as a weapon. Speaking to the Financial Times in an interview published Friday, Scott said both governments had reached a kind of balance before China decided to “fire shots” by threatening to cut off exports of critical minerals. That, he warned, crossed a line. He said China will not be able to keep using rare earths as a tool of pressure, especially now that it showed its hand. Scott pointed out that the United States sees the move as a major miscalculation.By showing its willingness to use rare earths to hit back, China exposed itself. Washington is already pushing for alternatives, and this new escalation has only sped things up. Scott said the U.S. and its partners no longer have the luxury of assuming those minerals will be freely available. Scott, the soybean farmer, says he’s felt the pain too Scott also took a moment to talk about the other front in this trade fight: soybeans. During an interview with Martha Raddatz on ABC News, Scott said, “I’m actually a soybean farmer… I have felt this pain, too.” China’s been effectively blocking U.S. soybeans for months, and Scott happens to be one of the people impacted. Sort of. He owns farmland in North Dakota where soybeans and corn are grown. His holdings are worth somewhere between $5 million and $25 million, and they generate between $100,000 and $1 million a year, based on his financial disclosure. But let’s not pretend Scott’s depending on those crops. Forbes says his net worth is about $600 million. So when China, once America’s biggest buyer, slapped heavy tariffs on soybeans in May, after President Donald Trump imposed duties on Chinese imports, the pain wasn’t evenly spread. Since the tariffs, China hasn’t bought any American soybeans at all. Regular farmers, the ones who depend on crop sales, are the ones really feeling it. Scott said the embargo is hurting, but the truth is, he can take the hit better than most. Still, the fact that the Treasury Secretary is directly affected by a trade standoff with China adds a strange twist. TikTok deal moves forward after Trump order On top of the rare earths and soybeans, Scott said the TikTok deal is finally getting off the ground. During an interview with Fox Business, he confirmed that in Kuala Lumpur, both sides finalized the agreement and are waiting for it to move ahead. “I would expect that would go forward in the coming weeks and months, and we’ll finally see a resolution to that,” he said. The fight over TikTok has dragged on for more than a year and a half. In 2024, Congress passed a law ordering TikTok’s Chinese owner, ByteDance, to sell off the app’s U.S. assets by January 2025. Trump followed that up with an executive order on September 25, saying the sale plan meets the law’s national security conditions. The clock’s ticking. Buyers have 120 days to seal the deal, and Trump pushed the final deadline to January 20, 2026. Under the new plan, ByteDance will only hold less than 20% of TikTok U.S. and get just one seat out of seven on the new board. The other six will be Americans. The app’s algorithm, used by 170 million Americans, will be retrained and monitored by U.S. cybersecurity partners, with full control shifting to the new joint venture. Even so, John Moolenaar, the Republican who chairs the House Select Committee on China, is still not sold. He said the licensing agreement for the algorithm, which is part of the deal, “would raise serious concerns.” China’s Commerce Ministry, on its end, said it plans to “properly handle” the matter and will work with the U.S. to sort out remaining issues. But Washington seems to have made up its mind. If you're reading this, you’re already ahead. Stay there with our newsletter .