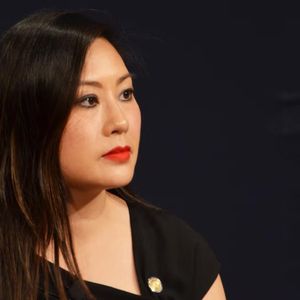

BitcoinWorld Stunning Bitcoin Price Prediction: Ripple CEO Forecasts $180K by 2026 Could Bitcoin’s price truly surge to $180,000 in the next few years? At a recent major industry event, a prominent CEO placed a bold bet on that exact scenario. Ripple’s Brad Garlinghouse made headlines with a specific and optimistic Bitcoin price prediction , forecasting the flagship cryptocurrency will reach $180,000 by the end of 2026. This forecast isn’t just a random number; it’s grounded in a shifting market landscape that has many experts turning bullish. What’s Behind This Bold Bitcoin Price Prediction? Speaking at Binance Blockchain Week, Garlinghouse shared his reasoning with the audience. His confidence stems largely from evolving regulations in the United States. For years, regulatory uncertainty acted as a dark cloud over the crypto industry, deterring institutional investment. Garlinghouse argues this fog is finally lifting, providing the clarity large-scale investors need to enter the market with confidence. This regulatory progress, combined with the inherent scarcity of Bitcoin (capped at 21 million coins) and growing global adoption, creates a powerful recipe for price appreciation. When institutions like hedge funds, banks, and publicly traded companies allocate even a small percentage of their portfolios to Bitcoin, the demand can skyrocket. Key Factors Supporting a $180K Bitcoin Target Let’s break down the core elements that could propel Bitcoin toward this ambitious price target. Several converging trends provide a foundation for this Bitcoin price prediction . Institutional Adoption: The approval of Bitcoin ETFs has opened a massive, regulated gateway for traditional finance. This brings unprecedented levels of capital into the market. Regulatory Clarity: As Garlinghouse emphasized, clearer rules reduce risk for businesses and investors. A stable regulatory environment encourages innovation and investment. Macroeconomic Hedge: With concerns about inflation and currency devaluation, many view Bitcoin as “digital gold”—a scarce asset to preserve wealth. Halving Cycle Dynamics: The next Bitcoin “halving” is expected in 2024. Historically, this supply-cutting event has preceded significant bull markets. Is This Bitcoin Forecast Realistic? Examining the Challenges However, every Bitcoin price prediction must be weighed against real-world challenges. The path to $180,000 is not guaranteed. Market volatility remains extreme, and Bitcoin’s price can swing dramatically on news, macroeconomic shifts, or technological developments. Furthermore, while U.S. regulation is improving, the global landscape is a patchwork. Crackdowns in other major economies could create headwinds. Competition from other cryptocurrencies and potential technological issues also pose risks that investors must consider. Therefore, it’s crucial to view any long-term forecast as a well-informed projection, not a certainty. Actionable Insights for Crypto Investors What does this mean for someone interested in cryptocurrency? First, use bold predictions as a starting point for your own research, not as financial advice. If Garlinghouse’s Bitcoin price prediction intrigues you, consider the following steps: Diversify: Never invest more than you can afford to lose, and consider a balanced portfolio beyond just Bitcoin. Focus on Fundamentals: Look beyond the price. Understand the technology, use cases, and long-term vision of any crypto asset. Adopt a Long-Term View: Crypto markets are cyclical. Prepare for volatility by focusing on a multi-year horizon, not daily price movements. Conclusion: A Vote of Confidence in Crypto’s Future Brad Garlinghouse’s $180,000 Bitcoin price prediction for 2026 is more than just a number. It is a powerful vote of confidence from a seasoned industry leader. It signals a belief that the foundational challenges of regulation are being solved, paving the way for the next wave of adoption. While the future is unwritten, this forecast highlights a growing consensus that Bitcoin’s journey is far from over, and its next chapter could be its most dramatic yet. Frequently Asked Questions (FAQs) Who made the $180K Bitcoin prediction? The prediction was made by Brad Garlinghouse, the CEO of Ripple, during his speech at Binance Blockchain Week. What is the main reason for this optimistic forecast? Garlinghouse cited increasing regulatory clarity in the United States as the primary positive factor, as it reduces uncertainty for institutional investors. When does he predict Bitcoin will hit $180,000? The specific timeline given is “by the end of 2026.” Should I invest in Bitcoin based on this prediction? No single prediction should be the basis for an investment. Always conduct your own thorough research, understand the risks of cryptocurrency’s high volatility, and consider consulting a financial advisor. What is a Bitcoin halving, and why does it matter? A halving is a pre-programmed event that cuts the reward for mining new Bitcoin blocks in half, reducing the new supply entering the market. It occurs roughly every four years and has historically been associated with bull markets. Are there risks to this prediction? Yes. Potential risks include renewed regulatory pressures in key markets, extreme volatility, macroeconomic downturns, and technological challenges or competition from other assets. Join the Conversation Do you agree with this bold Bitcoin price prediction ? What factors do you think will most influence Bitcoin’s price in the coming years? Share your thoughts and this article with your network on social media to discuss the future of cryptocurrency with fellow enthusiasts. To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin institutional adoption and price action. This post Stunning Bitcoin Price Prediction: Ripple CEO Forecasts $180K by 2026 first appeared on BitcoinWorld .