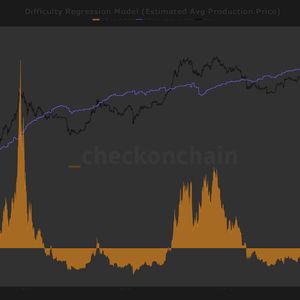

Michael Saylor, Chairman of the Board of Directors of Strategy (MSTR), known for its strategy of accumulating Bitcoin (BTC) reserves through the company’s balance sheet, confirmed that MSCI is holding talks with the organization regarding the possibility of removing the company from the indices. “We are in communication with MSCI throughout this process,” Saylor told Reuters, adding that contacts were ongoing ahead of the critical decision. MSCI is considering a policy to exclude companies whose business models rely heavily on cryptocurrency acquisitions from its indexes, arguing they resemble mutual funds. The decision is expected to be announced by January 15. According to JP Morgan, Strategy's removal from the MSCI USA and MSCI World indexes could lead to outflows of up to $8.8 billion if other index providers follow suit. Saylor, however, argues that these expectations are exaggerated: “I don’t think it makes any difference,” said the famous CEO, adding that JP Morgan’s fund outflow projections may not be accurate. Bitcoin's steepest monthly decline since mid-2021 in November directly impacted Strategy, whose balance sheet is heavily reliant on Bitcoin. Earlier this week, the company sharply revised down its year-end profit forecast, announcing a potential loss of up to $5.5 billion. A month earlier, the company had forecast a profit of $24 billion. Saylor noted that Strategy is inherently vulnerable to volatility: “The stock will naturally be volatile because the company is built on amplified Bitcoin. If Bitcoin falls by 30-40%, the stock will fall even more. That's the nature of this structure.” Saylor also argued that the company operates with 1.11 leverage and is capable of withstanding even a 95% crash in Bitcoin's price. Related News: SEC Surprises This Time - They Are Blocking Some Cryptocurrency Products from Entering the Market Strategy's inclusion in indices was a key driver of demand for its stock, particularly through MSCI-based ETFs and other passive investment vehicles. A potential delisting could raise questions about the company's ability to raise funds through equity and debt in the future. Among the new criteria MSCI is discussing is removing companies from its indexes if their digital asset positions exceed 50% of total assets. This directly targets companies like Strategy, which have a Bitcoin-heavy balance sheet. On the other hand, Saylor believes such a decision would not lead to any meaningful change in the company's operation or long-term strategy. *This is not investment advice. Continue Reading: This $8 Billion Development Could Impact Bitcoin: Michael Saylor Is Trying to Persuade