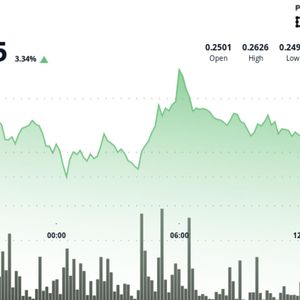

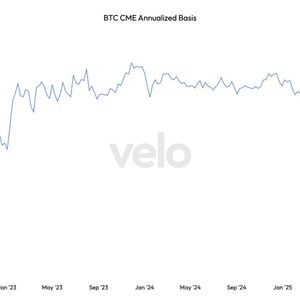

Ethereum broke out of a months-long descending trendline and reclaimed the $3,000 level, marking its strongest short-term recovery in several weeks. Improving momentum indicators support the move — but traders are urging caution as rising leverage across derivatives markets threatens to amplify volatility. Powered by Outset PR , this analysis reflects the agency’s commitment to strategic, data-backed communication in the crypto industry. Outset PR helps Web3 brands amplify their narrative and convert momentum into measurable outcomes. ETH Breaks Trendline and Flips Momentum Indicators Bullish Ethereum’s reclaim of $3,000 comes after a notable technical shift. ETH cleanly broke above a descending trendline that had capped upside since early Q3, suggesting momentum is turning. Key indicators reinforced the breakout: MACD histogram flipped positive (+33.26), showing renewed bullish momentum. RSI at 44 indicates ETH has room to run before nearing overbought conditions. Buyers also defended the $2,800 support zone during a brief mid-day dip, signaling strong demand from spot traders. Record-High Leverage Ratio Raises a Red Flag Despite the bullish turn, the derivative markets are flashing a warning. Binance’s ETH leverage ratio hit 0.57, its highest level ever recorded as noticed by CryptoOnchain . Elevated leverage often represents crowded positioning — typically from aggressive short-term speculators — and creates conditions for sudden liquidation cascades. As ETH approaches tighter resistance zones, this leverage imbalance increases the risk of sharp intraday volatility. ETH Key Levels Two zones now anchor Ethereum’s near-term outlook: • Resistance — $3,055 (EMA cluster) ETH must clear this level to convert the breakout into a structured uptrend. • Support — $2,800 The trendline retest held here. Losing $2,800 would invalidate the recent bullish shift. How Outset PR Leverages a Data-Driven Approach to Crypto Storytelling As Ethereum’s price structure shifts, so does the narrative environment around ETH — and this is where Outset PR has distinguished itself. Founded by crypto PR strategist Mike Ermolaev, Outset PR approaches communications like a hands-on workshop, crafting narratives that align with market momentum rather than relying on generic outreach. What sets the agency apart is its data-first methodology, powered by its internal intelligence suite Outset Data Pulse . This system tracks media trendlines, sentiment cycles, and traffic distribution patterns to determine the exact timing and angles that give a client’s message the highest possible lift. A central tool within this workflow is the agency’s proprietary Syndication Map, which identifies which publications consistently trigger downstream syndication across crypto aggregators such as CoinMarketCap and Binance Square. Because of this approach, Outset PR campaigns routinely achieve multi-layered visibility, often reaching up higher exposure of the initial placement as stories propagate through secondary channels. By connecting market events — such as key technical shifts in ETH — with timing-optimized storytelling, Outset PR ensures that every campaign is market-fit, narrative-aligned, and delivered precisely when the audience is most receptive. ETH Price Outlook Ethereum’s move above $3,000 is technically encouraging, backed by a MACD reversal and fresh demand from spot buyers. But with leverage at record highs, the rally remains sensitive to abrupt reversals. Should the price break above $3,055, the momentum will likely extend. On the flip side, breaking below $2,800 would invalidate the current uptrend. ETH’s next move will likely be shaped by the tug-of-war between improving technicals and a leveraged market structure that could either accelerate gains or magnify losses. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.