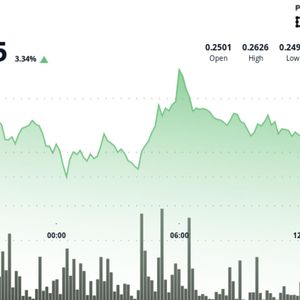

The holiday season often brings a surge in crypto market activity as liquidity narrows, sentiment improves, and traders position for potential upside. With the 2025 Christmas rally approaching, several altcoins are already flashing early strength. Reactor ($REACT) , XRP, and KAS stand out as leading candidates for investors looking to enter before momentum accelerates. 1. Reactor (REACT) — Most Undervalued Altcoin Ahead of the Santa Rally Reactor continues to gain traction as one of the most practical and feature-rich platforms in DeFi. Its token, $REACT, powers a trading ecosystem designed to simplify the fragmented world of decentralized finance. The platform consolidates spot execution, perpetual DEX trading, memecoin discovery, and multi-protocol yield inside a single, professional-grade interface — something retail and pro traders have been seeking for years. $REACT also benefits from a demand-driven token model. As platform usage grows, commission revenue fuels buy-backs and token burns, tightening supply over time. Early buyers still have the advantage of a 66% presale discount, boosted staking rewards (10% → 28%), and priority access to new tools and partner drops. Nearly 10 million tokens are already sold — showing accelerating demand ahead of the rally. With real utility, an active user base, and a strong value loop, REACT is the leading altcoin to watch heading into Christmas 2025. Buying Now Means Securing $REACT at the Best Price Before Demand Rises 2. XRP — Momentum Turns Positive, but Key Resistance Ahead XRP is beginning to recover after a volatile period, breaking above both its 7-day SMA at $2,18 and the 50% Fibonacci retracement level at $2,22. These signals indicate a shift in short-term trend strength, supported by a technical signal: the MACD histogram flipped positive (+0,012753) for the first time since November 25. This MACD crossover is a buy signal, which explains the recent pickup in volume. However, XRP still faces a major hurdle at the 200-day EMA near $2,61, a level that shapes the broader trend. If XRP can maintain support at $2,14, bulls may attempt another push toward higher levels. A breakdown, however, risks a retest of the $2,06 support zone. For now, XRP enters December with improving momentum but must clear its long-term resistance to confirm a sustained rally. 3. KAS — Bullish Structure Intact as Price Pushes Against Resistance Kaspa is quietly strengthening, with its price climbing to $0,0566 and breaking above both the 7-day SMA ($0,05636) and the 30-day EMA ($0,0512). This alignment confirms a short-to-mid-term bullish structure. The RSI(14) at 55,8 reinforces the move — it reflects solid buying pressure without drifting into overbought territory, giving KAS room for further upside. The challenge now lies at the 23,6% Fibonacci level ($0,0555). This resistance has capped recent attempts to continue higher. A clean breakout would set the stage for a more decisive push, while rejection could briefly slow the trend. Even with this resistance overhead, KAS enters the Christmas rally window with favorable technical conditions and a solid trend foundation. Final Thoughts The Christmas rally often rewards assets that combine real utility, strong momentum, and supportive technical structures. REACT leads thanks to an active platform, revenue-driven tokenomics, and high-value presale access. XRP is showing its first meaningful momentum shift in weeks, with algorithmic traders turning bullish. KAS maintains a clean upward structure and sits just below a level that could unlock further gains. For traders positioning ahead of late-December volatility, these three altcoins offer some of the most compelling setups for 2025’s holiday season. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.