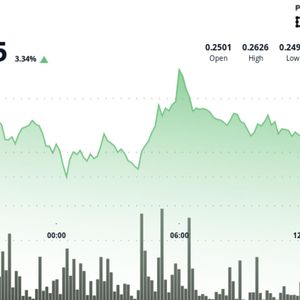

XRP ETFs Outpace Ethereum and Solana Products XRP exchange-traded funds continued gaining momentum this week as new data showed the products climbing past the $800 million inflow mark faster than every crypto ETF except Bitcoin. The surge came only two weeks after their debut, giving XRP an early lead over Ethereum and Solana products. XRP reached $844.99 million in net inflows after only 13 trading days. This performance made XRP the third crypto asset to cross the $800 million line. Bitcoin achieved the mark in two days and Ethereum reached it after 95 sessions. XRP now stands out for its pace, despite entering the market more than two weeks after Solana. Moreover, XRP ETFs surpassed the progress of Solana ETFs, which collected $650.81 million after 25 days. The data also underscored the difference in rollout timing. Solana funds launched earlier because issuers completed their filings faster during the government shutdown. Hence, XRP’s performance indicates strong investor interest that continues to build despite the delayed start. Vanguard Adds XRP ETFs to Its Digital Assets Category Vanguard updated its Digital Assets section and included a full lineup of XRP funds. The list features active, index-based, leveraged, and premium-income ETFs. The additions also include products from Bitwise, Franklin Templeton, Canary, CoinShares, ProShares, REX-Osprey, and Amplify. Consequently, retail and institutional clients now gain access to regulated exposure through a single platform. The broad availability suggests growing demand among traditional investors who prefer familiar brokerage channels. Additionally, the variety of fund structures signals deeper market maturity around XRP-based financial products. Price Holds Above Key Support as Analysts Watch $2 Level XRP traded near $2.16 with daily volume above $4.7 billion. Market data showed a 4.70% increase over the past day. Analyst Ali Martinez identified $2 as the key support. He also highlighted $1.20 as the next critical zone. Source: X The chart shows lower highs forming as sellers test momentum. However, buyers continue defending the $2 floor. A rebound above $2.20 may open a path toward $2.40. A drop under $2 may shift attention to the broader $1.80–$1.20 demand region. Conclusion XRP continues to attract significant capital as ETF inflows strengthen across major platforms. Vanguard’s decision to list multiple XRP products adds another layer of support. Hence, the combination of strong demand, expanded access, and key technical levels places XRP in a decisive phase. The coming sessions will show whether buyers can hold the $2 zone and maintain the positive trend.